Terry is a Fellow of the Chartered Association of Certified Accountants (FCCA) with extensive industry experience as a qualified accountant. After 20 years in industry and practice Terry moved into the education sector moving to Swansea University in 2010 where she now teaches taxation and accounting to undergraduate and postgraduate students.

Covid 19 – are our tax students coping?

Introduction

When the UK government imposed lockdown on 23 March 2020 to reduce spreading of Covid 19, universities quickly switched learning from face to face delivery to online learning. This quick adaptation allowed teaching and learning to continue but at what cost? How did our students cope with lockdown and at what impact on their health and studies?

Research conducted at Swansea University in April 2020 captured the thoughts and concerns of final year undergraduate taxation students. Questions asked were how they were coping with the transfer to online learning, what worked for them and what did not particularly in their exam preparation.

Lecturer’s perceptions of online learning was to recreate a similar experience to the usual face-to-face lecture and seminar delivery assuming that students were equally motivated and engaged with the new way of working. However, lecturers were unable to gage the effectiveness of online learning as students became invisible online, often joining the sessions anonymously without camera’s or engagement. It was impossible for lecturers to know how students were coping with the changes to their learning and which resources they found helpful to prepare them for their online examinations.

Methodology

This study involved requesting 165 final year undergraduate students enrolled in a taxation class to complete a voluntary questionnaire in April 2020 through the university’s VLE.

Questions focused on the transfer to online learning with a view to providing additional resources and support before the online examinations.

Results of the study

Demographics

Of the 42 students who responded to the questionnaire, the majority were between the ages of 20 and 25 years old. Although the class had a 50:50 male/female split the questionnaire respondents were mainly female. Around half of the respondents are from the UK and 50% international students with Chinese students being the largest international student group. In April 2020, the majority of students (60%) were at home with the remaining students based in Swansea on either campus or local accommodation.

Feelings towards lockdown and online learning

Results from the questionnaire found 57% of the students who responded said they had adapted well to online learning during lockdown, however, 42% struggled with their studies and 29% found the switch to online learning difficult at first but found it easier after the first few weeks. A quarter of the students experienced no problems with the transition to online learning.

Where students indicated they were struggling with their online studies 50% sought support, mainly from friends and family with some accessing university support services. Two students who stated they were struggling with their studies had sought support from the medical profession.

Views of online examinations

Most of the students were positive about online assessment (68%) with 21% unsure and just 11% having negative thoughts about it. Student’s comments were generally supportive of tax assessed via an online examination although some students thought an essay or piece of coursework would be more appropriate.

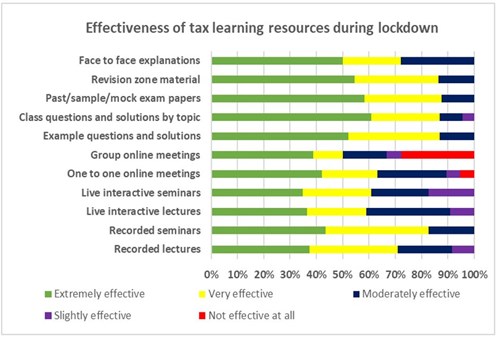

Effectiveness of taxation learning resources

Some students were missing face-to-face explanations with others lacking fast and consistent Wi-Fi making online lectures more difficult. Some recorded lectures were of poor quality and needed replacing.

Conclusion and lessons learned

- A useful exercise to identify how students were coping and address additional resources needed to support students prior to their remote exams.

- It was clear that many students found the adjustment to online learning difficult with many seeking support from friends, family, and others from the university or medical profession.

- Some students had technology issues e.g. slow Wi-Fi– something to consider for 2020/21.

- Identified the need to get to know your students to support them better in 2020/21.

- Planning for 2020/21 teaching will include short exercises to monitor student progress, identify those who need additional support and engage with those students regularly.

Fiscal Publications has been around for over 30 years providing a publication outlet for all kinds of tax and related materials. Some of the most widely used University textbooks in tax are within our portfolio.

Andy Lymer, CEO

FISCAL PUBLICATIONS